News

As an entrepreneur, you most likely know how important it is to thoroughly complete your documentation and deliver it to the accounting office on required time. One has to remember to submit their...

September 30, 2021 is the final deadline for using any outstanding holiday entitlement for the year of 2020. Paid annual leave is guaranteed by the Labour Code. Employees are entitled to use...

On August 27, 2021 Karolina and Maria, our representatives of JWW Accounting Office, participated in the celebrations of the 25th anniversary of the Polish-German Chamber of Industry and Commerce....

On September 10, 2021, JWW Accounting Office participated in the celebration of International Oktoberfest 2021. This is the 16th edition of this event, which took place in the Toya Golf &...

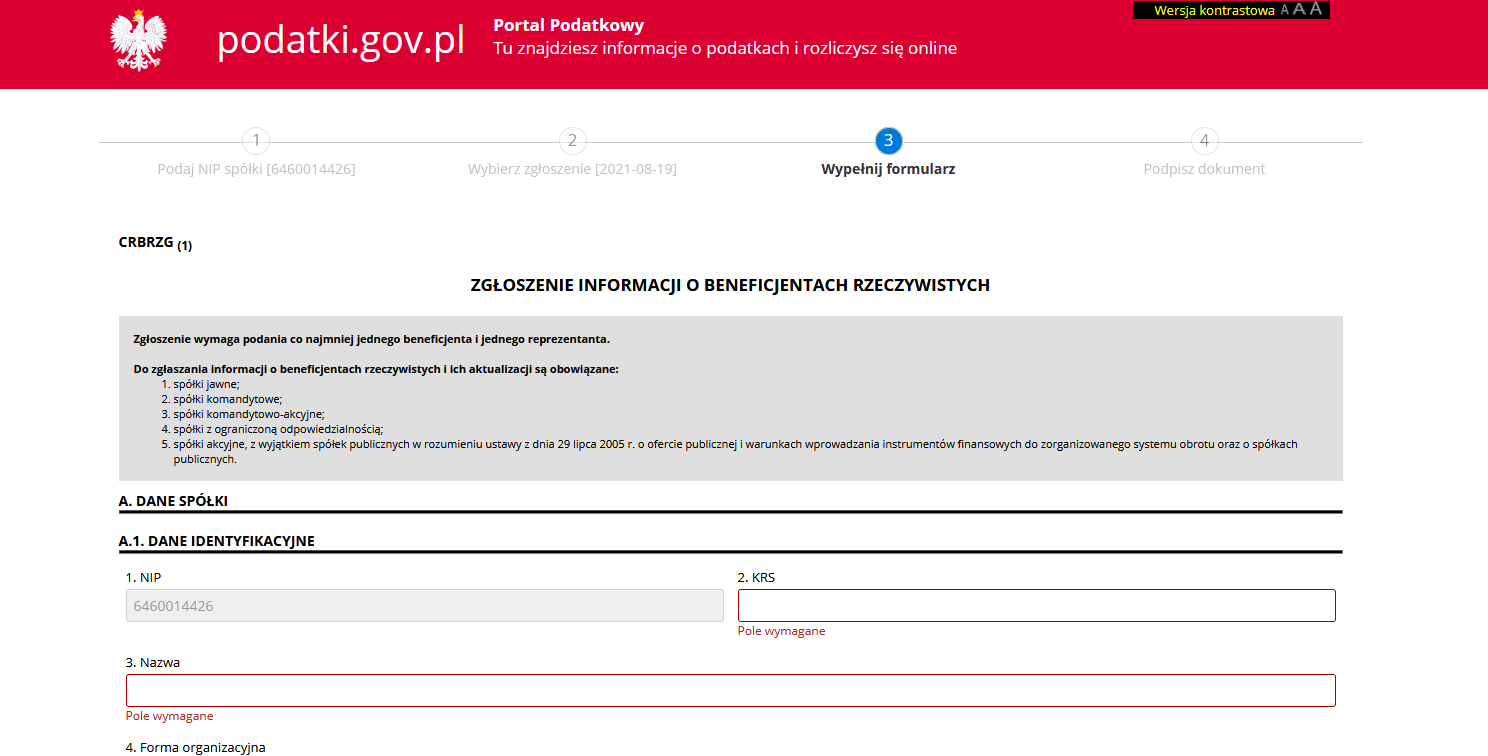

What is CRBR? CRBR – Central Register of Beneficial Owners (pl: Centralny Rejestr Beneficjentów Rzeczywistych) is an electronic system in which information on beneficial owners is collected...

What is CRBR? The Central Register of Beneficial Owners (CRBR) is an electronic system that collects and processes information about beneficial owners. As we have already written here, the...

In Dziennik Ustaw (Journal of Laws) a regulation concerning changes in the application forms of identification was published as well as modifications to update forms and supplementary data forms....

On September 20, 2021 viaTOLL will be completely terminated and subsequently replaced with e-TOLL system. e-TOLL is a new way of collecting electronic tolls on designated sections of freeways,...

The Ministry of Finance has announced that starting with October 2021, entrepreneurs will be able to use structured invoices (so called e-invoices) as well as the National System of e-Invoices...

Dear Customers, in order to maintain good partnership relations, we are sharing information regarding additional obligations that we are required to follow due to the Anti-Money Laundering and...

Since July 2021, it is no longer possible to submit an application for registration or update data in the National Court Register (KRS) using paper forms. The only acceptable method for submitting...

Many entrepreneurs who run their businesses often use services, applications or advertising of contractors from abroad to promote themselves on, for example Facebook, Google or LinkedIn. It is...

Beginning with 1 July 2021, JWW Accounting Office has officially joined the ranks of BPCC members. Therefore, all clients operating in Poland and the UK will be able to receive consistent and...

As we have already written here, on 01/07/2021 a number of changes regarding electronic commerce and import, the so-called small parcels to the European Union. The e-commerce VAT package is to...

The end of May is the perfect start for any outdoor team-building activities. Therefore, this year we decided to kick off the season with a kayaking trip in the Barycz Valley located in the...

The New Polish Order – changes in taxation The key element of the New Polish Order is the introduction of a wide package of changes in taxation. According to the information that were...

On May 22, 2021 more than 10,000 people across Poland gathered up to start the charity race in order to support people who are under the care of Everest Foundation. The Corporate Run is not just an...

Additional care allowance until May 23, 2021 – who is entitled to it? Due to the epidemic situation and the closure of nurseries, kindergartens and care facilities, the Council of Ministers...

Starting with May 16, 2021, a change will be made regarding applications to ZUS. Upon reporting the insured to ZUS, in addition to the data presented so far, the payer will be required to provide...

A stoppage refund from ZUS, PLN 5000 subsidy, partial refinancing of the employees’ remuneration, and an exemption from ZUS contributions are the support forms provided in the amendment of the...