News

The content of the new law on the automation of handling specific matters by the National Revenue Administration changes the entering of VAT groups into force from 1 July 2022 to 1 January 2023....

According to Article 13(1) of the VAT Act, an intra-Community supply of goods (ICS) stands for an export of goods from the territory of Poland to the territory of a Member State that is other than...

We very much know how important is team building for good morale. That’s why, good morale within our JWW team can translate into healthy relationships with our customers. For instance, last...

Shopping for business purposes or personal use? When acquiring goods or services you are obliged to determine its purpose, i.e. whether you buy it for the purposes of your business activity or for...

Let this Easter bring you a time of respite and rest, filled with joy, health and mutual kindness. May you use the upcoming time as best as possible in the group of the closest people. We...

We are pleased to announce that JWW Accounting Office has won the title of the Ethical Company 2021 in the category of small and micro enterprises. For 8 years now, the competition has rewarded the...

With the start of January 1, 2022, there have been significant changes regarding the signing procedures of financial statements. The amendment to the Accounting Act makes it possible for people who...

“Very human accountants with flair and imagination” – this is what Puls Biznesu writes about JWW, which distinguished us in the prestigious competition of the most dynamic Polish...

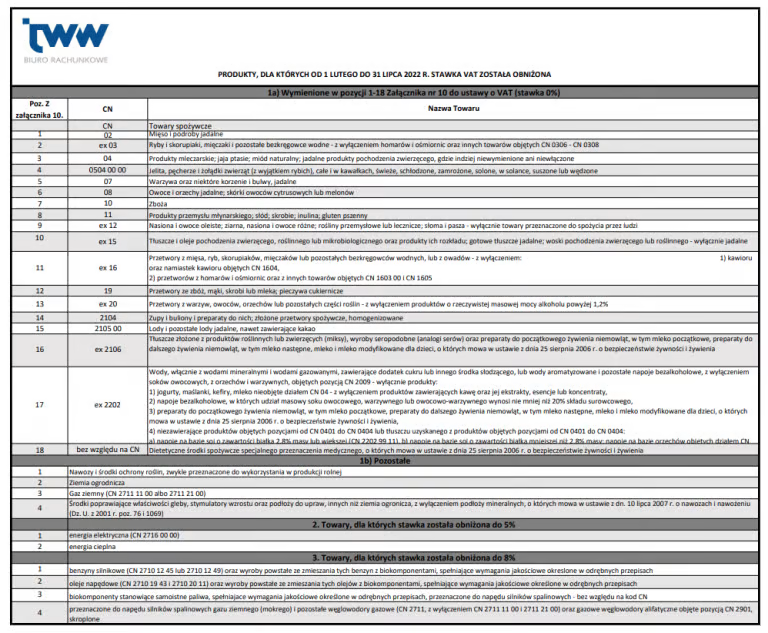

As of February 1, the Anti-Inflation Shield 2.0 has come into effect. It introduces a temporary reduction in VAT rates on, among others, fuels, heating, and electricity, as well as zero VAT on...

Changes in regulations in the Polish Deal introduce more favourable rates for taxpayers paying lump-sum tax compared with previous years. As a reminder, the deadline for changing the form of...

Your Best Accountant reminds you of the possibility of changing the form of taxation. Such information should be reported to the competent tax office. Importantly, the selected form of taxation...

The years 2020 and 2021 are revolutionary for accounting offices. New guidelines are constantly emerging regarding their activities (e.g. GDPR, AML, reporting to MF), which require constant...

On the occasion of the upcoming Christmas, we wish you all the best. May this special time be spent without haste and worries, filled with peace and joy among loved ones. Thanking you for...

Beginning with January 2022, the deadlines for paying ZUS contributions and submitting settlement documents is going to be changed. For the majority of entrepreneurs, this means a later deadline...

Polish Deal introduces an additional article in the Entrepreneurs’ Law, according to which the entrepreneur must enable the customer to pay with a payment tool. According to the programme...

On November 26, 2021, JWW became a member of the National Chamber of Accounting Offices (KIBR). The organization was established in response to the regulations of the Polish Governance and aims to...

On October 31, the list of entities that are required to report information concerning beneficial owners to the Central Register of Beneficial Owners was extended. The new obligations involve...

Beginning with January 1, 2022 changes in the TAX FREE system related to the amendment of the Law on Goods and Services Tax are coming into force. TAX FREE is to provide sellers with quick and easy...

In the Q4 of 2021, JWW Sp. z o.o. was awarded the Gold Emblem of Quality International 2021 in the Highest Quality Services category. The group of independent experts recognised our accounting, HR...

Any entrepreneurs who have been entered into the National Court Register (KRS) and who prepare financial statements are obligated to place them in the Repository of Financial Documents which is...