Anti-Inflation Shield 2.0

As of February 1, the Anti-Inflation Shield 2.0 has come into effect. It introduces a temporary reduction in VAT rates on, among others, fuels, heating, and electricity, as well as zero VAT on certain food products. The VAT reductions apply from February 1, 2022, for six months, i.e., until the end of July 2022.

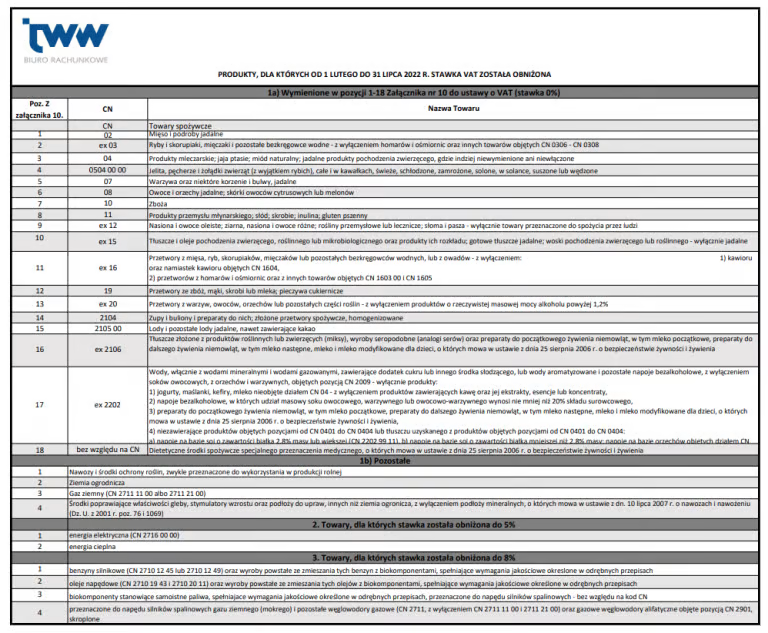

The second edition of the Anti-Inflation Shield is a continuation of government efforts to mitigate the effects of inflation and, consequently, reduce the burden on taxpayers. A detailed list of products covered by the changes is presented in the table:

IMPORTANT! From February 1, 2022, to July 31, 2022, it is required to display in the cash register area of the business premises, where the sale of food products, motor fuels, and goods used for agricultural production takes place, a clear notice about the VAT rate reductions on these goods, indicating the applicable rate.

The templates are available on the Ministry of Finance’s website:

https://www.gov.pl/web/kas/tarcza-antyinflacyjna–wzor-informacji-i-zakres

Until July 31, 2022, sellers of natural gas, electricity, and heat are required to provide buyers of these goods with information on the reduced VAT rates applicable to these goods:

- by attaching this information to each invoice or other document indicating payment for these goods, or

- separately, if the invoice or other document indicating payment for these goods is sent later than two months after the effective date of this law.

Legal Basis: – The Act of January 13, 2022, amending the VAT Act, signed by the President on January 26, 2022.

See also

We are pleased to share that Alliott Global Alliance (AGA) has once again been recognised in the prestigious Chambers Global Guide 2026, maintaining its position as a Leading Law Firm Network....

The operation of Family Foundations involves the need to properly comply with the provisions of the Accounting Act and tax regulations. Below we present the key obligations related to the...

Reminder: The National e-Invoicing System (KSeF) is a nationwide ICT platform used for issuing and receiving structured invoices. Ultimately, KSeF is intended to streamline document circulation,...