Registration to the polish Central Register of Beneficial Owners (CRBR) step by step

What is CRBR?

The Central Register of Beneficial Owners (CRBR) is an electronic system that collects and processes information about beneficial owners.

As we have already written here, the obligation to register and update data in CRBR applies to companies registered in the National Court Register (KRS):

- limited liability companies;

- general partnerships,

- limited partnerships,

- limited joint-stock partnerships,

- simple joint-stock companies (from July 1, 2021),

- joint-stock companies, except for public companies as defined by the Act of July 29, 2005, on public offerings, conditions for introducing financial instruments to organized trading, and on public companies (Journal of Laws 2019, item 623).

Who is a beneficial owner?

A beneficial owner is an individual or individuals:

- who directly or indirectly control a company through rights that stem from legal or factual circumstances, enabling decisive influence on the activities or decisions of the company, or

- on whose behalf business relationships are established or an occasional transaction is conducted.

For a company – a legal entity, other than a company whose securities are admitted to trading on a regulated market subject to disclosure requirements under EU law or equivalent laws of a third country, the beneficial owner is:

- an individual who is a shareholder or stockholder owning more than 25% of the total number of shares or stock in that legal entity,

- an individual holding more than 25% of the total voting rights in the company’s governing body, including as a pledgee or usufructuary, or based on agreements with other voting rights holders,

- an individual controlling a legal entity or entities that collectively own more than 25% of the total number of shares or stock in the company or collectively hold more than 25% of the total voting rights in the company’s governing body, including as a pledgee or usufructuary, or based on agreements with other voting rights holders,

- an individual controlling the company through rights specified in Article 3(1)(37) of the Accounting Act of September 29, 1994 (Journal of Laws 2019, item 351), or

- an individual holding a senior management position in the company’s governing bodies in the case of documented inability to determine or uncertainty regarding the identity of individuals specified in the above points and if there are no suspicions of money laundering or terrorism financing.

Who must submit data to CRBR?

Data to the Central Register of Beneficial Owners (CRBR) must be submitted exclusively by an individual authorized to represent the company.

This task cannot be delegated to other individuals (in accordance with Article 61(1) of the Act of March 1, 2018, on counteracting money laundering and terrorism financing (Journal of Laws 2020, item 971).

When should registration in CRBR be completed?

After registration in KRS, entities have 7 days to register in CRBR. Failure to register or delay may result in a high fine – up to 1 million PLN.

How to register in CRBR?

- Step 1 Create a submission

- Step 2 Enter the NIP and choose the legal form of the company

- Step 3 Choose the submission

- Step 4 Enter company details

- Step 6 Review and print UPO

Step 1 Create a submission

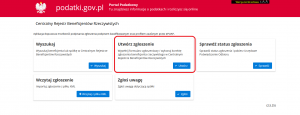

Go to the CRBR registry website: https://crbr.podatki.gov.pl

To register, click on Create a submission.

Step 2 Enter NIP and choose the legal form

In the NIP field, enter the tax identification number.

In the organizational form field, expand the dropdown and select the appropriate option, then click Next.

Step 3 Choose the submission

Enter the submission date. For the first registration, this will be the current date.

For updates, information about the company’s previous submissions will appear here. Corrections to the submission can also be made here if the previous submission contained incorrect data.

Provide the date of the event. For changes in beneficial ownership, such as due to the sale of shares, this will be the date of the share transfer agreement.

For new companies, this will be the KRS registration date. For existing companies at the time of the registry’s launch, indicate the date the submission was sent to CRBR.

Then click Create new submission.

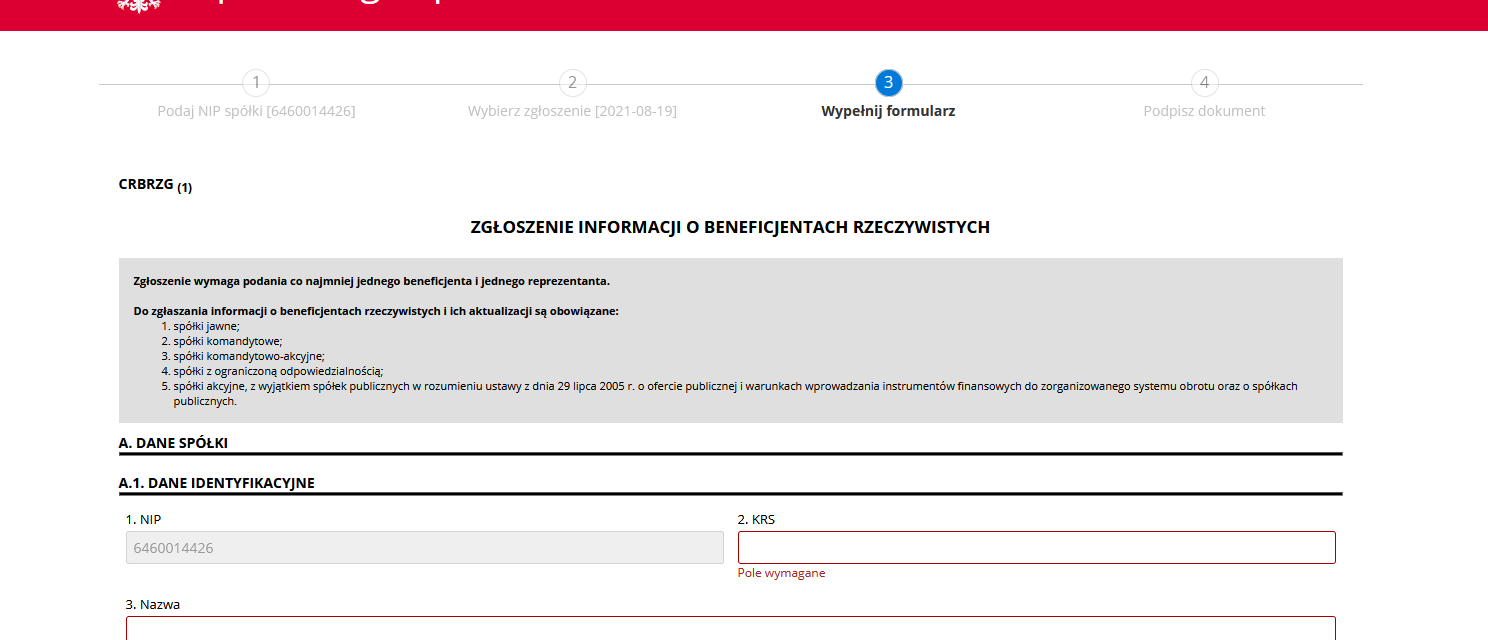

Step 4 Enter company details

In Section A, provide basic information about the company.

Step 6 Review and print UPO

In the final step, sign the document and submit it. If multiple signatures are required, save the document as a .xml file.

The submission must be signed with a qualified electronic signature or via the trusted profile on ePUAP. If joint representation is required, it must be signed by all required individuals. The order of signatures does not matter.

If your submission is successfully verified, you will receive a confirmation message. You can download the UPO by clicking the Download UPO button.[:]

See also

From October 15–16, 2025, the capital of Lower Silesia once again became the heart of innovation, technology, and entrepreneurship. Under the slogan “Power of Synergy”, another edition of...

On October 22, at Ace of Space in Renoma, Wrocław, an exceptional event from the SoDA Finance Live Workshop series took place, dedicated to finance and accounting in the IT industry. Among the...

On October 8th, in the exceptional spaces of the National Forum of Music in Wrocław, one of the most important startup events in Poland took place – Pitch MeetUp 2025. This year’s edition...