ZAW-FA in KSeF – Step-by-Step Guide on How to Complete the Form and Obtain Access Rights

The ZAW-FA form (“notification of granting or revoking rights to use KSeF”) is a key document for managing access to the National e-Invoicing System (KSeF) in Poland. Without properly submitting this form, individuals in a company may not be able to issue, receive, or manage e-invoices.

What to Know Before Filling It Out

Before you start:

- The form consists of five main sections: A, B, C, D, and E.

- Fill in only the white fields — grey fields should remain blank.

- Section D is filled in only in special cases (e.g., changing a qualified signature certificate, or for foreigners without a NIP/PESEL).

- The ZAW-FA form can only be submitted in paper form at the tax office.

- Make sure your email address is current — the tax office will use it to send notifications about granting or revoking access rights.

- ZAW-FA is used to designate the first authorized person in the company. Only this person can later grant additional rights (e.g., to employees).

- The form is available for download here.

When You Don’t Need to Submit the ZAW-FA Form

You do not need to submit ZAW-FA in the following cases:

- You are a sole proprietor (JDG) — you automatically have owner-level rights in KSeF. You can log in using your Trusted Profile (ePUAP) or qualified electronic signature, provided it includes your NIP or PESEL number.

- You have a qualified company seal — logging into KSeF with this seal automatically grants you owner-level rights, without the need to submit ZAW-FA.

Step-by-Step Instructions for Completing the ZAW-FA Form

Section A – Tax Office and Purpose of the Notification

- Select the appropriate tax office — the one responsible for your registered business address or place of business.

- Purpose of submission (field 6) — choose one option:

- granting rights,

- revoking rights,

- reporting qualified signature data (e.g., when changing the certificate).

- Field 4 — complete only if you’re submitting multiple ZAW-FA forms at once (e.g., for different people).

Note: If you select “reporting signature data,” Section C (person’s details) will be skipped.

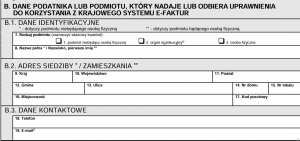

Section B – Details of the Submitting Entity

In this section, enter the data of the company or person granting or revoking access rights:

- Type of entity:

- Non-natural person (e.g., company),

- Enforcement authority,

- Natural person (e.g., sole proprietor).

- Name or full name – company name or the individual’s full name.

- NIP – tax identification number.

- Address – company headquarters or residence address, depending on entity type.

- Phone (optional).

- Email (mandatory).

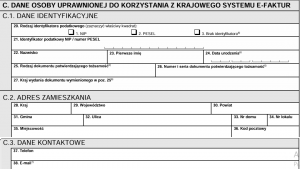

Section C – Details of the Person Whose Rights Are Granted or Revoked

Complete this section if you are granting or revoking rights (unless you are only submitting signature data):

- Type of identifier (field 20):

- NIP,

- PESEL,

- No identifier — choose the appropriate option.

- NIP or PESEL number – depending on your choice.

- Full name of the authorized person.

- Residential or correspondence address.

- Phone (optional).

- Email (mandatory).

If you selected option 3 (no identifier), you must also provide ID document details (series, number, type, issuing country) and date of birth.

Section D – Additional Data (Signature, Foreigners)

Fill out this section only if:

- In Section A you selected “reporting qualified signature data,”

- The person being granted access does not have a NIP or PESEL,

- You are changing the qualified signature, and the tax office requires updated identification data.

Provide details identifying the qualified signature (e.g., certificate fingerprint or other required data) as indicated in the form’s instructions.

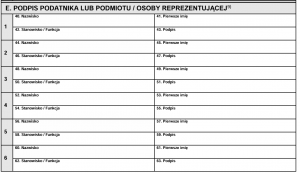

Section E – Signature and Date

- The form must be signed by a person authorized to represent the entity (e.g., a board member or owner).

- Enter the date and place of signing.

- If rights are granted by multiple people (e.g., several board members), use an additional ZAW-FA form to include all representatives.

After Submission – What Happens Next

- After submitting the ZAW-FA form, the tax office will assign one individual the right to manage the KSeF account for the given entity.

- Only this person will have full owner-level rights and will be able to grant access to other users (e.g., employees or an accounting office) electronically within KSeF.

- If the authorized person leaves the company, their rights must be revoked — ensuring that at least one active owner-level user remains in the system.

See also

From October 29 to November 2, 2025, Aleksander Widawski, CEO of JWW Accounting Office, took part in the annual Alliott Global Alliance Conference, held this year in Toronto, Canada. The event...

On October 20–21, Wrocław hosted another edition of the Polish Congress of Entrepreneurship – the largest national event bringing together the business, academic, and local government...

From October 15–16, 2025, the capital of Lower Silesia once again became the heart of innovation, technology, and entrepreneurship. Under the slogan “Power of Synergy”, another edition of...